by Ben Morales, CEO QCash Financial

As I reflect on the past year, I am filled with a sense of deep gratitude. As a company we continue to grow and expand our reach, which has resulted in wonderful opportunities to change more lives. 2019 has been a building year for us. Similar to a sports team developing and building players for the future, we added new players, upgraded systems, streamlined some of our processes, and helped clients navigate the changing world of banking. Let’s look at some of the highlights.

Before we got used to writing “2019,” we signed two new clients. Florida Credit Union has experienced steady growth in their new small dollar loan program – consistently reaching more members each month. While SkyPoint Federal Credit Union has offered a similar product for many years, they recognized the market need for broader product reach and worked with us to streamline their loan process.

“We knew we needed to improve the options members have to affordably access cash quickly. Implementing QCash has been a powerful step in broadening this offering for our credit union,” said James Norris, III, SkyPoint FCU President and CEO. “We are member-driven and this is the right thing to do for them.”

We recognize the first step in helping members break a cycle of debt is often providing access to short-term credit when they have nowhere else to go. Borrowing wisely from a trusted institution protects members from being taken advantage of. Once the roof leak is repaired or the teenager has shoes that fit, only then are members able to begin learning about financial health and work toward wellness.

This fall we signed one of our largest clients, Baxter Credit Union (BCU). Among the nation’s Top 100 credit unions with over 250,000 members, BCU specializes in serving the employees and families of America’s best workplaces. We are excited about this partnership because small dollar loans help BCU fulfill their purpose of empowering people to discover financial freedom. As BCU says, “Here Today For Your Tomorrow.” And this winter Tucson Federal Credit Union (TFCU) joined our movement. TFCU strives to ‘Give Back’ in numerous ways and offering small dollar loans fits with their mission of creating an exceptional experience for each person, each day. Last year TFCU received their designation as a low-income credit union. QCash Financial’s products fit very well into the strategy of providing services to those of modest means. They will be providing a helping hand when members need it most. I am confident we will see TFCU making a dramatic impact in their members’ lives in 2020.

Shifting our focus to the progress we’ve made within our team, this spring we updated our mission statement: empowering financial institutions to improve the financial wellness of their communities. The small dollar loans offered through our platform by our clients gives members hope as they work toward a brighter financial future. In fact, our 18 clients in 13 states totaling nearly $28 billion in assets are providing access to over two million members – generating 12,000 loans a month!

We gain great satisfaction knowing we help empower credit unions to guide their members out of the cycle of debt and toward financial health. And this year financial wellness came into focus nationally. In fact, financial wellness is now on the to-do list for many financial institutions in 2020. We’re here to help them with this goal.

In the fall of this year, our team volunteered for the United Way Day of Caring event as a sign of our commitment to our own community. We had the privilege of cleaning up the grounds and garden at a local senior living complex in Olympia, where our headquarters is located. We really enjoyed ‘getting our hands dirty’ and getting to know some of the residents. Each year the residents build an emergency food supply in case of power outages or other emergencies. We added to their supply. What a great exercise to remind us to be physically prepared for the unexpected.

In other news, this fall NewsWatch TV aired a segment on our Financial Wellness App, which is currently in a pilot program with our parent company, WSECU. In a Credit Union Journal article, Kevin Foster-Keddie, former president and CEO of WSECU and Chairman QCash Financial explained, “The app integrates with a member’s account and uses customized content, personalized coaching, cognitive behavioral change techniques and intentional digital design to induce positive financial health changes. We’re excited to help people build savings habits, reduce their overdraft charges or increase on-time loan payments.”

The app uses cognitive behavioral therapy (CBT), a proven form of psychotherapy seeking to identify, challenge, and modify behaviors and thoughts using in-the-moment feedback. One on one guidance is provided by a coach to personalize the education and support. A cover story in Banking CIO Outlook magazine features our new product – read the feature article now.

In closing, we are building a movement – a movement that is focused on providing broad access to small dollar, short term credit across all communities as a first step toward good member financial health. The next step is to help them once they raise their hand and say they would like help to become more financially healthy.

Throughout the year, I talk with many industry leaders and I have found people who are wondering if financial literacy really can improve one’s life. Is it actually working? Even defining financial wellness can be a challenge.

Financial wellness or well-being refers to the overall financial health of an individual and their relationship with money. It involves the process of learning how to successfully manage financial expenses – including month-to-month expenses, retirement, and the unexpected. Money plays an important role in our lives. Without access and support, most members cannot dig themselves out of debt. The American Psychological Association found that 62 percent of Americans reported money was a significant source of stress in their lives.

The path to financial wellness can be overwhelming. A large number of Americans need help becoming financially stable and resilient. We have the opportunity, if not the obligation, to share what we know and lend a hand. Together, we can help them move from crisis to opportunity. Financial literacy is key to empowering members who want to gain control over their finances.

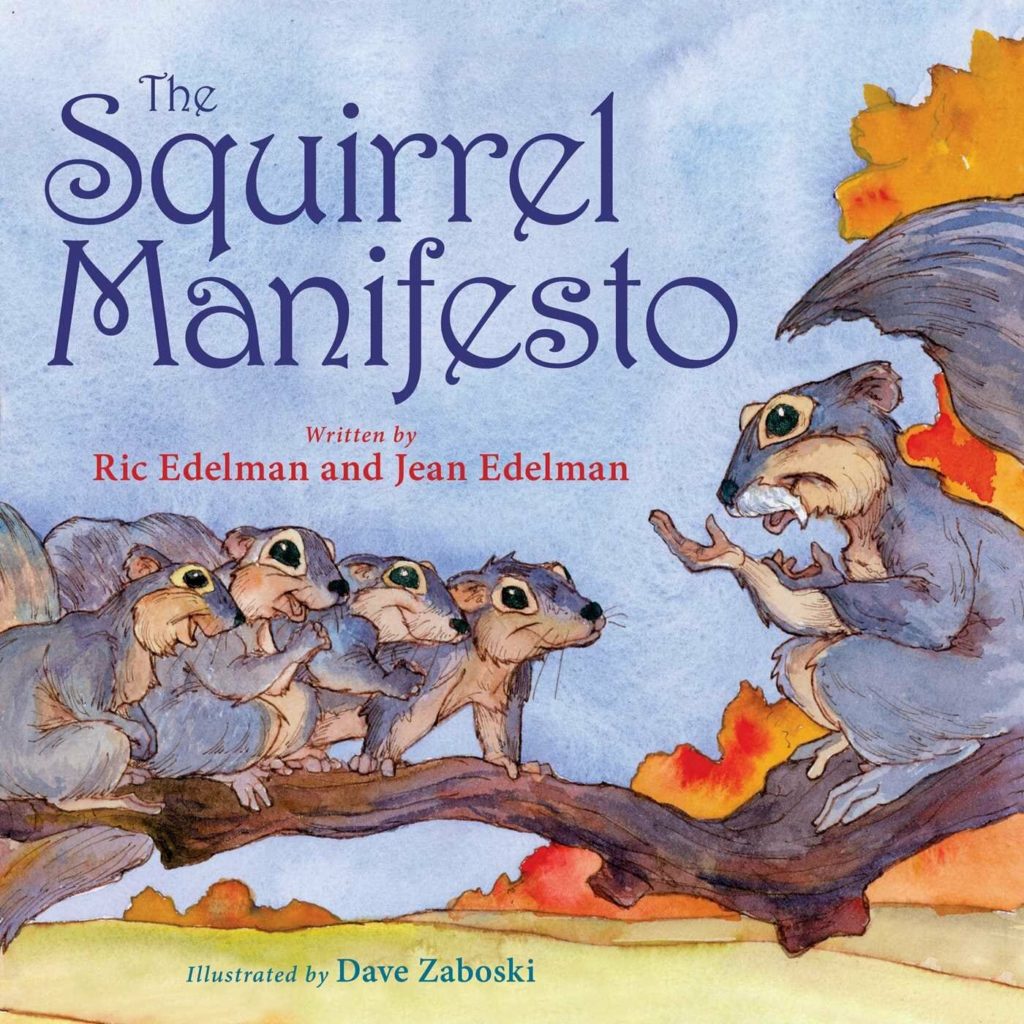

Although, it is still early for measurable results, those members who have been involved in the pilot report experiencing lower stress and greater confidence as they begin to take control of their financial future. We are excited by these promising signs knowing all ages need to learn these skills. And even kids can grasp the four basic principles of money that it’s important to spend a little, save a little, give a little and tax a little. The book, The Squirrel Manifesto, teaches the very basic concepts that help young children build a healthy relationship with money that can last them a lifetime. Let’s start early!

Financial wellness is not a fad. It is here to stay. How can you help educate others and improve lives in your community?

Let’s partner in 2020 to create a better tomorrow.

Happy Holidays!