It is true that in some ways, credit unions are similar to regular banks — both offer checking and savings accounts, credit cards, loan opportunities, and other financial services and products. The fundamental dynamic that differentiates one from the other, however, is the people who profit; shareholders and executives for banks, members for credit unions. That alone makes all the difference when it comes to offering the best, most advantageous services for members and customers.

After all, credit unions are not-for-profit institutions whose mission is to “encourage thrift, savings, and the wise use of credit; to increase the knowledge and ability of our members to manage the control of their financial well-being…”

This community-centric philosophy, the financial health-oriented dynamic that sets credit unions apart, is the driver that makes financial education outreach a central feature of credit union culture.

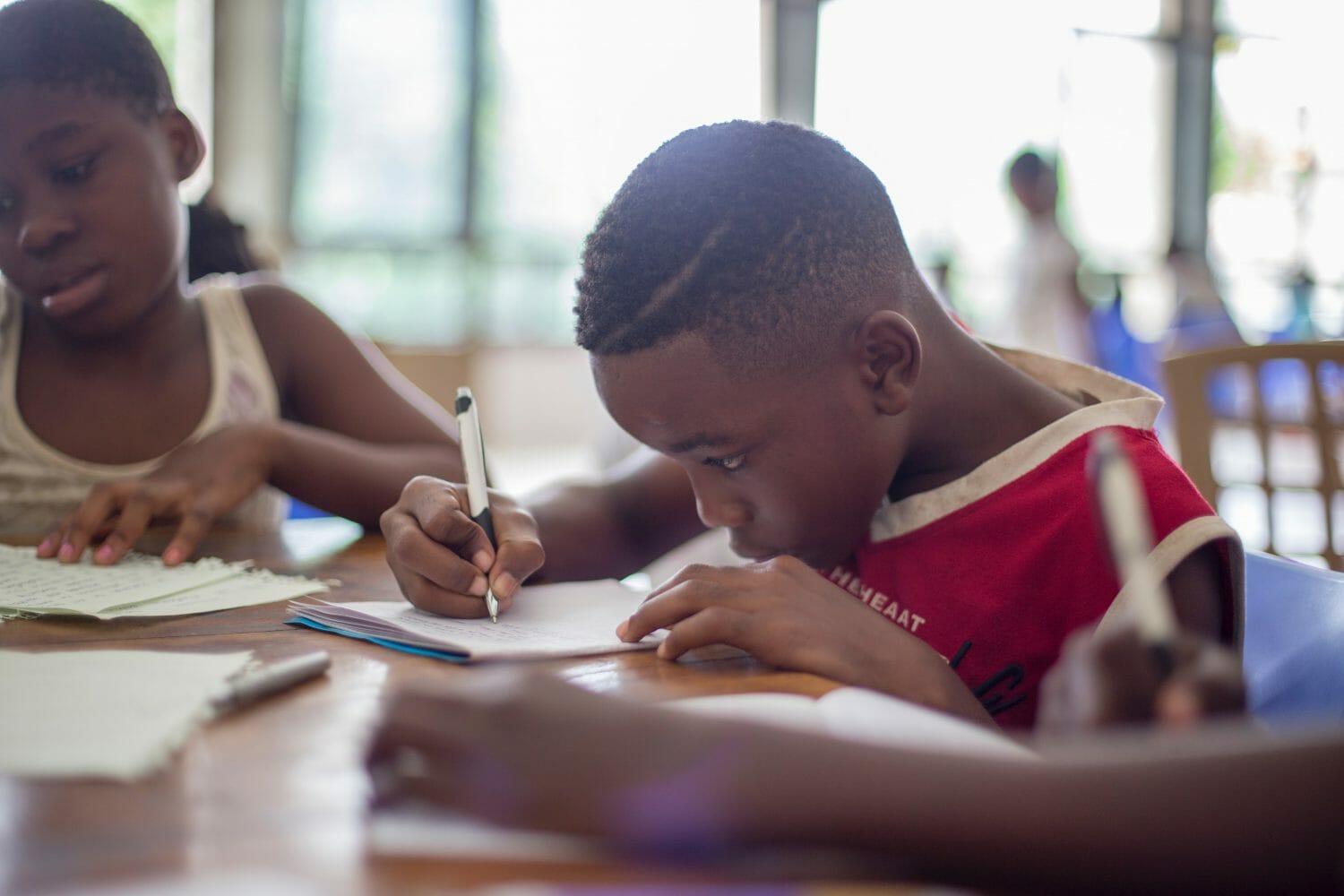

Offering excellent customer service and financial mentorship, many credit unions also reach out and give back to their local communities in creative and generous ways. Some serve the community through financial education with community classes, online courses, or free credit counseling, while others endeavor to promote economic and social justice by reaching out to lower-income, rural, and at-risk communities. Still others simply seek to increase financial awareness for the betterment of their community, and offering credit union membership as desired.

Even in the midst of COVID-19, QCash Financial is highlighting three digital financial health initiatives from credit unions around the country that may inspire your branch to safely reach out and promote personal economic empowerment in your community.

Silver State Schools Credit Union

Matching the extremes of the Nevada desert, Silver State Schools Credit Union CEO Scott Arkills is turning up the heat on improving people’s lives through financial education and literacy. Arkills has a long history of holding valuable seminars, going in-depth on such topics as “Understanding Credit,” “How to Finance Your First Home Loan,” or “How to Finance an Auto.” At a prior position, Arkills partnered with a local university on a financial boot camp with the purpose of infusing real-life experiences into the academic curriculum. Now with Silver State, Arkills is in the process of continuing that mission by conducting similar financial education seminars in local Vegas-area schools.

First Source Federal Credit Union

Featuring free classroom financial education presentations for all grade school levels through college, in addition to employee wellness fairs and continuing development, First Source Credit Union supports their communities’ financial education and literacy needs while consciously adhering to current social-distancing protocols through virtual classes. Each of these comprehensive topics are tailored to audiences based on age and financial background, so no one gets left behind!

General topics covered in First Sources’ curriculum include:

- Financial Basics and Money Management

- Credit

- Saving and Budgeting

- Investing

- Careers

Stanford Federal Credit Union

International students at Stanford University were recently offered a financial education webinar from Stanford Federal Credit Union to learn about banking in the United States and to differentiate how they might handle finances in other countries. The course covered how students might handle adjusting to life on campus,how the U.S. financial system operates, the difference between different types of bank accounts and products offered by various financial institutions, and how good credit can help them gain a well-rounded vision of how finance operates.

A growing realization is emerging that the ultimate measure of success of financial education and literacy is about improving an individual’s overall financial well-being. With credit union outreach examples like those listed above you can still affect, serve, and provide value to your community in the toughest of times, even during a global pandemic. Want to learn more about QCash’s Financial Wellness app? Contact us today!