For years, consumer advocacy groups and federal agencies like the Consumer Financial Protection Bureau (CFPB) have fought to hold to account or eliminate predatory payday lenders in states across the country.

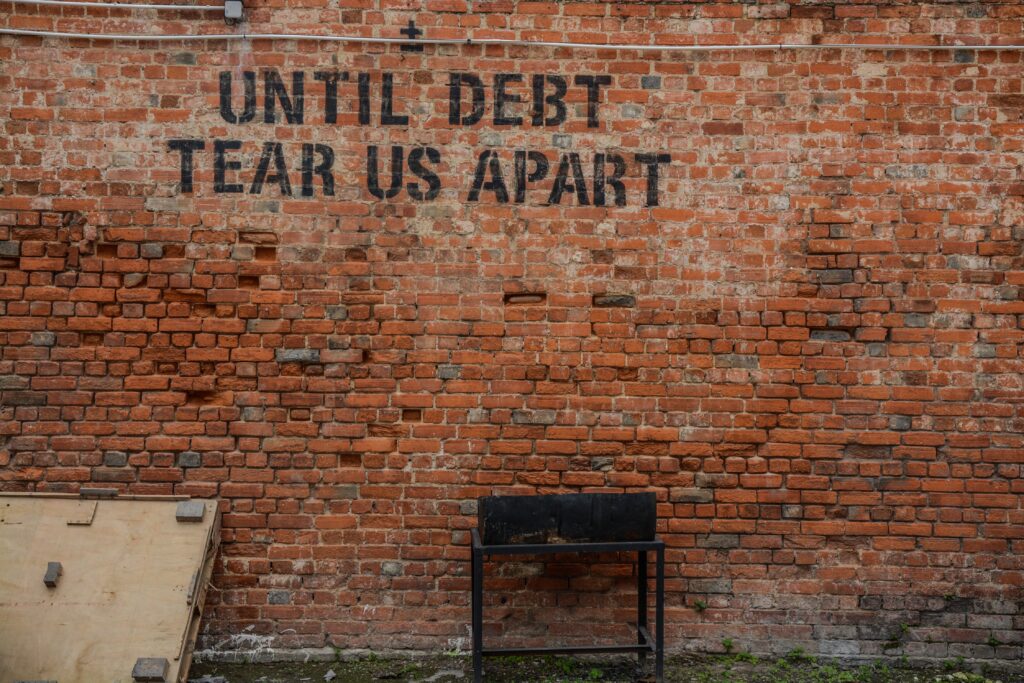

Regardless of extensive documentation of the business-dependent practice of the payday lending “debt trap” and the billions payday lenders have systematically fleeced out of low-income families and communities – particularly those of color – the predatory payday lending industry has shrewdly constructed and exerted its political power in state capitols throughout the United States.

Many states still permit usurious interest rates for payday lenders, with often dire consequences for millions of financially-unaware, hardworking American consumers already struggling with more month than money.

Making small dollar loans “SAFE” for credit union members and consumers

The seemingly endless fight for consumer protections continues and offers hope as new legislation was recently introduced in Congress to further curb deceptive and predatory payday lending practices from hurting America’s individuals and working families.

Introduced as the Stopping Abuse and Fraud in Electronic Lending Act (SAFE) was put forward in the Senate by United States Sen. Jeff Merkley (D-OR) and the House by Reps. Suzanne Bonamici (D-OR) and Pramila Jayapal (D-WA).

This proposed SAFE Lending Act would make into law three primary principles to make consumer lending more secure and transparent. The three principles are described as follows:

- Consumers must have control of their own bank accounts. This means that third-party entities (i.e. predatory payday lenders) cannot get control or automatically access a consumer’s account through remotely-created checks (RCCs); that is, checks from the borrower’s bank account created by that third party.

- Allow the consumer to regain control of their money and increase transparency. This principle would require all payday lenders, including financial institutions, to abide by state rules for the payday-like, payday-adjacent loans they may offer consumers in a particular state. Also, payday lenders would be required to register with the CFPB. On top of that, the law would ban overdraft fees on prepaid cards provided by payday lenders while requiring the CFPB to supervise any other fees affiliated with the prepaid cards.

- This principle is a ban on deceitful lead generators and anonymous payday lending. Various websites like to describe themselves as “payday lenders” when they’re actually “lead generators” who round up applications and actually auction them off to the real predatory lenders.

Bill’s advocates back the cause for consumer protections from payday lenders

As one may tell from the principles cited above, the SAFE Lending Act is taking aim to protect consumers from deceptive and predatory payday lending practices that essentially pick the pockets of vulnerable individuals and working families by putting the hammer down on some of the worst, most shameless abuses stemming from the payday lending industry.

“Before we kicked the payday lenders out of Oregon, I saw up close how payday lenders trapped families in my blue-collar neighborhood in an inescapable vortex of debt,” Rep. Merckley explained. “This legislation will ensure important consumer protections, protect state laws like Oregon’s, and create guardrails to prevent consumers from being trapped in a cycle of debt. American families work hard for their earnings, and they shouldn’t end up with their financial foundations ruined just because of one medical emergency or a surprise car repair.”

Payday lenders with access to consumers’ bank accounts are also issuing the money from loans on prepaid cards, which include harsh overdraft fees. When such cards are overdrawn, the payday lenders have all the access they need to reach into the members’ bank accounts and apply the additional charge, only adding to the consumers’ battle with financial instability.

“It’s unacceptable that predatory lenders continue to trap consumers in a cycle of debt, taking advantage of families and individuals in times of financial distress,” says Rep. Suzanne Bonamici. “I’m pleased to lead the SAFE Lending Act with Senator Merckley and Rep. Jayapal to protect consumers across the country from these dangerous, unscrupulous practices and to provide needed transparency.”

Merckley, Bonamici, and Jayapal stressed that while states have enacted tough laws to curb abusive lending, again, some payday lenders employ anonymous websites to prey on vulnerable individuals and families in times of financial vulnerability and economic distress.

“Working families across the country do not deserve to have their hard-earned savings stripped away by payday lenders who continue to use predatory tactics to trap people into debt,” says Rep. Jayapal. “The SAFE Lending Act will provide important guardrails to make sure working people and their families are protected against payday lenders and puts an end to the dangerous practices that entrap consumers.”

The bill is endorsed by Americans for Financial Reform, Center For Responsible Lending, Consumer Action, Consumer Federation of America, National Association of Consumer Advocates, National Consumer League, National Consumer Law Center, Public Citizen, and UnidosUS.