Believe it or not it’s already August, and the annual gravitational lure is drawing your eye to that often inconvenient and time-consuming priority: planning your financial institution’s 2020 budget.

Of course, it takes time to hammer out needs, requirements, and aspirations a given institution wishes to prioritize in the coming year – perhaps even fine-tune the annual plan inside of a five-to-10 year schedule. Regardless of the circumstances, survey after survey finds more than half of financial institutions’ administrators believe their organization’s approach to their future could and should improve, per BAI. When placed in the framework of the upcoming annual budget, that’s important, especially coming out of 2019 when the world finally leaned into the coming tsunami that is the financial technology revolution. Technology, and the companies who innovate within it, work in a matter of days rather than quarters. Fintech has arrived, and it will change banking, soup-to-nuts, forever.

Upon hearing those words many financial executives may tend to feel a cold shiver running through their nervous systems! While some may feel hesitant to embrace this new era in digital banking, others see these tectonic changes as the opportunities they are when deciding their 2020 budget. But what if the idea executives fear instead represented greater opportunity than they’ve ever had before, attracting and cementing relationships with future generations of customers? When banks and credit unions perceive fintech companies as the partners they are rather than the end of days, that’s when the magic happens.

And that’s the point; there are so many benefits fintech can offer financial institutions for the future it’s difficult to highlight just one solution. From services augmenting performance and improving profitability to maximizing customer retention, data enrichment and more, the question isn’t whether such customer-facing technology will help, it’s how much.

Among the many service assets fintech would introduce (or re-introduce, in this case) into the market includes small dollar lending tools and the public’s popular, yet inaccurate, perceptions of them. Long considered a losing proposition for banks and credit unions prior to the deregulations of the ‘80s and the rise of predatory payday lending in the ‘90s, this new era of digital banking is giving new life to the service, giving customers easy access to credit when and where they need it.

In 2018 the Office of the Comptroller of the Currency (OCC) issued new guidance to financial institutions to offer loans to their customers. Also in 2018, the American Banking Association (ABA) “highlighted the important role small dollar credit plays in helping consumers meet their financial needs, and called on regulators to remove barriers that impede banks from making small dollar loans.” (Source: PYMTS) The OCC’s paper also explored the consequences of overdrafts when financial institutions exclude an accessible small dollar loan program. “Consumers lose an average of $443 in purchasing power for each attempted check or ACH transaction that is returned due to insufficient funds in the consumer’s account. The total annual lost purchasing power is $43.7 billion.”

There’s no shortage of research indicating the necessity and profitability for financial institutions including small dollar lending programs into their portfolios. Such evidence includes the report from Pew Charitable Trust finding U.S. consumers spend in excess of $30 billion annually to borrow from predatory payday loans and other small dollar lenders outside the banking industry. “Consumers use these high-cost loans to pay bills; cope with income volatility; and avoid outcomes such as eviction or foreclosure, having utilities disconnected, seeing their cars repossessed, or going without necessities.”

The report also found the benefits loans provide are not strictly relegated to the lower-income consumers. The ABA white paper found middle-income consumers actually utilizing overdraft protection at higher rates than lower-income consumers. “In general, there is no typical user of overdraft protection; consumers across the income spectrum use overdraft protection and do so for many different reasons.” If that’s not a testimonial for the power of a small-dollar lending program, nothing is. In this emerging era of digital and mobile banking, regardless of the income demographics, the field is becoming more level for everyone, everywhere. The question is which financial institutions are ready to onboard the fintech necessary to provide the services customers need.

All this is not to say financial institutions won’t have their share of challenges ahead in establishing these needed loan programs. Predatory payday lenders and other nonbank lending outfits have been rooted in the public’s consciousness for three decades now, and market themselves aggressively. If financial institutions are serious about taking power away from such businesses and providing customers with a valid, more affordable small dollar alternative while pointing them towards a better sense of financial wellness for borrowers, they not only need to provide such a service, but put in the marketing efforts necessary to let customers and the public at large know about it. In addition, the Pew report said, “…banks and credit unions would need to compete with nonbank lenders on speed, likelihood of approval, and ease of application because small dollar loan borrowers usually seek credit when they are in distress.”

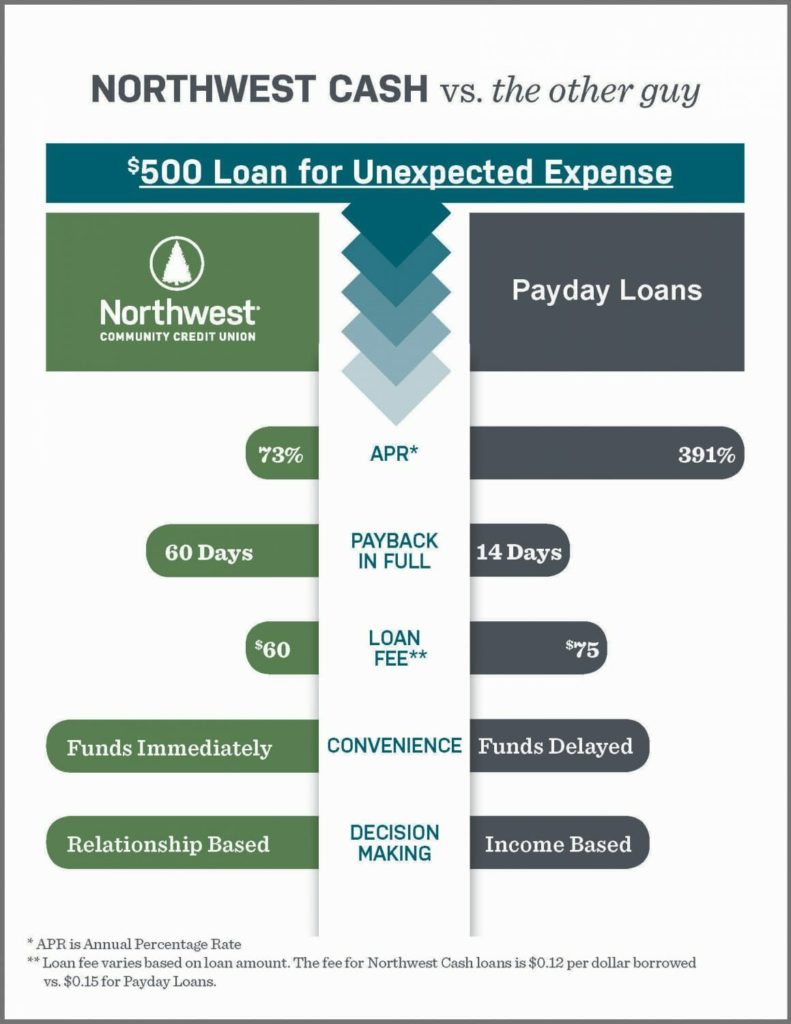

This is the crucial point in the movie where the hero pulls out the secret weapon at the last second letting the audience know all is not lost; the secret weapon with which has been with the hero the whole movie. Financial institutions’ advantage over predatory lenders is the natural lower cost of doing business, specifically the ability to offer beneficial loans to a good number of the same borrowers at six times the lower rate than the nonbank lenders. (Source: Pew) Put a solid, consistent marketing campaign(s) behind that service, and consider the results. Our current client Northwest Community Credit Union out of Eugene, Oregon is proving it can be done.

Now take that service, partner with a fintech like QCash Financial to utilize our white-label financial wellness and lending apps, and provide customers with easy-to-use mobile access to additional funds when and where they need it. You, too, can realize the true benefits this era’s new fintechs can provide your financial institution.