Despite the gradual economic recovery experienced in the United States following the pandemic in 2021, according to the Financial Health Pulse’s 2023 U.S. Trends Report released in September the financial health of Americans declined to pre-pandemic levels while some financial health have actually broadened over the last year and a half.

The FHN Trends Report clarified that between the spring of 2022 and the spring of 2023, while the share of financially healthy Americans did not necessarily change, the share of financially-vulnerable Americans increased to levels not seen since before COVID in 2019.

As the report examined the financial health of over 12 demographic and socioeconomic groups, a few key groups consistently stand out in the cause of financial health in America, particularly when it comes to inclusion and access to mainstream financial institutions. In Key Finding 1 mentioned above, the increased share of financially vulnerable Americans rose to 17 percent in 2023, up from 15 percent in 2022.

“The transient nature of the improvements in financial health observed during the pandemic and the declining financial health of historically marginalized groups is a stark reminder of how crucial it is to maintain a focus on equity when developing products and policies to support financial health,” says Jennifer Tescher, founder and CEO of the Financial Health Network.

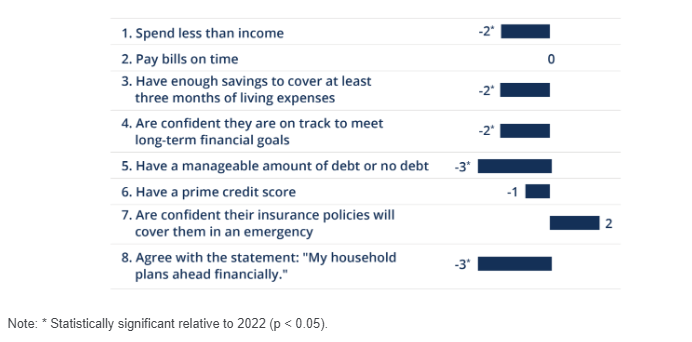

Key Finding 2 found declines in five of eight financial health indicators across all four pillars of financial health: spend, save, borrow, and plan. With nearly half, 49 percent, of Americans spending less than their annual earnings, this indicator came in as the lowest it’s been since FHN began research for financial health in 2018. In fact, three more indicators regressed to pre-pandemic levels: debt management, confidence in reaching long-term financial goals, and consensus that one’s household is planning ahead.

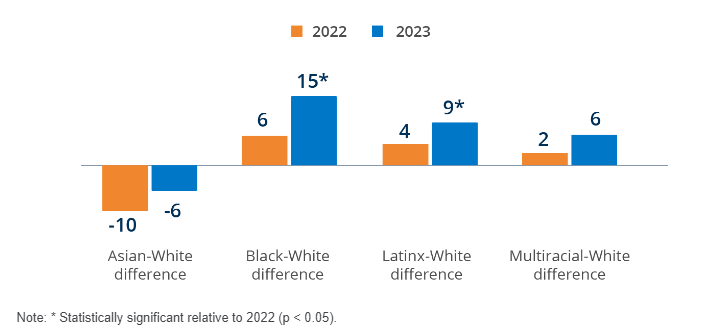

Key Finding 3 in FHN’s Trends Report concerned the widening gaps across race and ethnicity. It’s not exactly unknown, to put it mildly, that Back and Latinx Americans disproportionately experienced an increase in financial vulnerability and instability. As you can see in the FHN graph below, between 2022 and 2023 the share of Black and Latinx Americans who were financially vulnerable increased by six or seven percentage points. In fact, financial health gaps between Black and white Americans and between Latinx and white Americans grew over the past year.

This examination would be remiss if it didn’t include younger consumers’ state of financial health in 2023. The report found a growing share of financially vulnerable consumers among young Americans, resulting in a growing financial health divergence between younger consumers aged 18-35 and older Americans 65 and older in the last year. These younger Americans experienced difficulties in three of the four pillars of financial health: Spending, borrowing, and planning.

“With 43 million Financially Vulnerable people living in the U.S. today, this year’s Trends Report is a sobering reminder that financial health is out of reach for many Americans,” says Kennan Cepa, principal investigator and Senior Manager, Policy and Research at FHN. “With increases in Financial Vulnerability disproportionately concentrated among historically disadvantaged groups, there is an urgent need to identify solutions that work towards financial health for, not just some, but for all Americans.”

As financial inclusion goes, so goes financial health in America

It should be no surprise, then, to realize the direct relationship financial health has with inclusion when it comes to empowering American consumers and families. Financial inclusion, by its very application, is an enabler and proponent of widespread economic growth and stability, better financial health, job creation, and overall economic development. A financially-inclusive mainstream banking system is essential for any sustainable, growth-oriented social and economic infrastructure in any country.

That’s the glossy pamphlet version, anyway. The reality is, well, a bit (or a lot) more complicated.

Financial inclusion is still a pretty popular cause in the financial services world, and for good reason. Institutions and various industry companies promote its many benefits, yet not many of us actually know what it means to truly experience a lack of access to the mainstream U.S. financial system.

“About one in eight adults, or roughly 28 million Americans, are credit invisible – and another 21 million have unscorable credit,” says Nicole Elam, Esq., president and CEO of the National Bankers Association. “This makes it harder to access financial products and achieve financial milestones [like] buying a house, a car or qualifying for an apartment. Even utility and internet companies often require a credit history.”

According to the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development, financial exclusion inhibits individuals’ potential to earn, empower themselves in the event of a personal or external crisis, or construct any measure of financial health or economic durability. Affordable access and execution of key financial services products and services like QCash’s digital Life Event Loans helps individuals and their families recover and manage their income, improve cash flow, and work their way out of poverty to achieve better things.

In a recent Experian article published in June 2023, acting chairman of the Federal Deposit Insurance Corporation (FDIC) Martin J. Gruenberg attended a recent advisory meeting on economic inclusion and stated that while there is a continued downward trend in the overall rate of unbanked and underbanked households in the U.S., discrepancies still exist:

“It’s important to point out that even as we’ve continued to make progress, the significant demographic disparities in terms of who is unbanked and underbanked in the United States continued, particularly for African American and Hispanic households, for lower-income households, and for households with people with disabilities.”

Progress in financial recovery is possible, even probable

Even through all of that, good news shines from behind those dark curtains. Advancement is still advancement!

The segment of underbanked U.S. households in two years ago was just 4.5 percent, according to the FDIC’s National Survey of Unbanked and Underbanked Households, the lowest it’s been since 2009. Shifts in financial status, efforts to improve one’s financial health and inclusion, and innovations in fintech and digital offerings like speedy digital small-dollar lending have all chipped in on the effort to decrease unbanked and underbanked consumers and households.

Buoyed by such changes, Nicole Elam emphasizes the U.S.’s relatively newfound focus on financial inclusion as one of the most remarkable changes she’s seen. “Conversations have evolved from what you call it, to what it includes, to why it matters.”